Two different, separate information items inspired my blog writing for this week. Both are related to money, and how we treat and use money in our lives.

Two different, separate information items inspired my blog writing for this week. Both are related to money, and how we treat and use money in our lives.

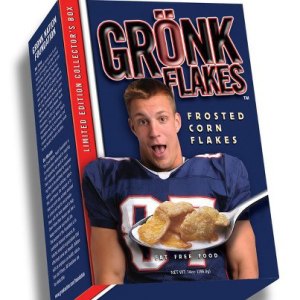

The first was a small note in a sports section of my local newspaper. The article was related to Rob Gronkowski, nicknamed Gronk, who is a well-known tight end for my favorite team, the reigning Super Bowl champ New England Patriots!

This article specifically highlighted Gronk‘s finances. It noted that over the course of his career so far, he has received over $10 million in signing bonuses and pay from his work as a pro football player.

What I found most interesting is that he has not spent a single penny of that $10 million yet. It is all saved and invested.

Instead, he lives on the money that he has obtained from endorsements stemming from his celebrity as football player. He had had multiple endorsement deals including Dunkin’ Donuts.

Instead, he lives on the money that he has obtained from endorsements stemming from his celebrity as football player. He had had multiple endorsement deals including Dunkin’ Donuts.

When asked to comment on the strategy, Gronk said that he knows that his football career will be short-lived, and he will need money to support himself for the remainder of his life.

My second money-related thought was stimulated by driving by a local bank the other day which had a sign out front advertising wedding loans at a low 4.99%. As I was looking at the sign, I was also saying to myself “Wedding loans? Wedding loans!?!”

My second money-related thought was stimulated by driving by a local bank the other day which had a sign out front advertising wedding loans at a low 4.99%. As I was looking at the sign, I was also saying to myself “Wedding loans? Wedding loans!?!”

I know that I am frugal (and I don’t have any daughters). However, as far as I’m concerned, if you have to get a loan to finance your wedding, you either shouldn’t get married or you should have a much cheaper wedding.

I know that some will tell me that the average wedding in the United States now cost $35,000. Basically, though, you’re spending a lot of money for one party on one day. That money could actually be used for a down payment on a house, to furnish an apartment, or to pay down other debt.

I know that some will tell me that the average wedding in the United States now cost $35,000. Basically, though, you’re spending a lot of money for one party on one day. That money could actually be used for a down payment on a house, to furnish an apartment, or to pay down other debt.

I was heartened to hear that a professional athlete, and an enormously popular one at that, was being financially responsible and planning for his future. I was also disheartened that some people are seriously willing to go into debt for a one-time party.

As befitting the theme of this blog, I feel that doctors and other medical professionals should be more like Rob Gronkowski (even if they are not Patriots fans like I am) and save for a financial future for which they will be responsible. I also definitely feel they should not be like the wedding couple or family that goes into debt for a short-term, and quickly depreciating, event.

As befitting the theme of this blog, I feel that doctors and other medical professionals should be more like Rob Gronkowski (even if they are not Patriots fans like I am) and save for a financial future for which they will be responsible. I also definitely feel they should not be like the wedding couple or family that goes into debt for a short-term, and quickly depreciating, event.

In summary, be more like Gronk. Also, before you or your child meets the future spouse of your or their dreams, save (don’t borrow) for that wedding day!